In this article.XMThis section explains the advantages and disadvantages of

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

Advantages and disadvantages of XM

XM Advantages.

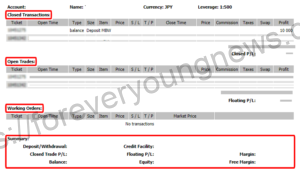

Reliable and secure. No rumours of deposit and withdrawal problems.

In foreign exchange trading, no matter how much profit you make, it is meaningless if you cannot withdraw your money.

In this respect, XM's greatest strength is that it is a safe and secure international forex broker.

XM has been in operation since 2009 and is now in its 13th year. While new brokers come and go, XM continues to provide a stable service and its operational track record is trustworthy enough.

XM has opened more than 3 million new accounts in 2021. It is growing at breakneck speed.

We often hear rumours of [withdrawal refusal] and [unfavourable execution] in the international FX community.

As for XM, there are virtually no such rumours.

Deposit bonuses and account opening bonuses are just abundant.

XM offers four bonuses: [Account Opening Bonus], [Deposit Bonus], [Loyalty Programme] and [Refer-a-Friend Bonus].

Account opening bonus

The account opening bonus is a bonus of 3,000 points (credits) that can be used for trading worth 3,000 yen just for opening an account. This means that you can start trading without having to make a deposit.

loyalty programme

Loyalty programmes award points for each lot transacted, and the points awarded can be exchanged for cash or credit.

Friend Bonus

The friend bonus literally means that if you refer a friend, a bonus is given to both parties. The conditions for receiving the bonus are a little difficult, but the key point is that you can receive it in cash.

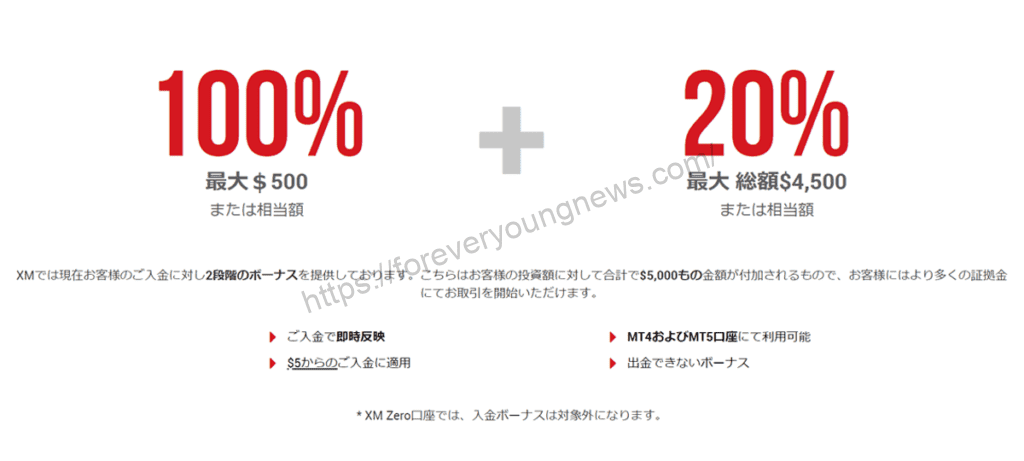

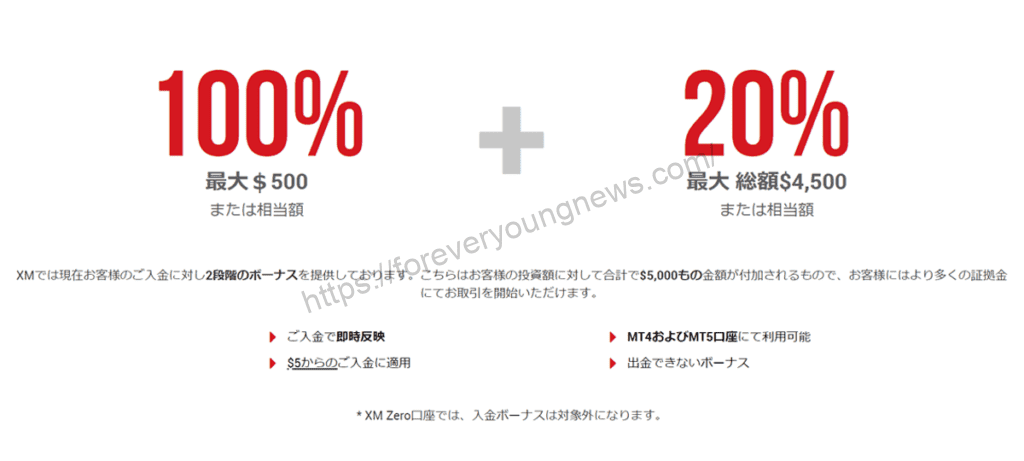

Deposit bonus

Deposit bonuses are credited according to the amount of the deposit, with 100% credit given up to JPY 50,000. So, with a deposit of JPY 50,000, you can effectively trade JPY 100,000.

For more information on deposit bonuses, see the following article.

No additional fees, so you can trade with peace of mind, even with high leverage.

The advantage of XM is still the ability to trade with leverage of up to 888 times without additional margin.

Compared to domestic firms, which incur additional margin, traders can trade without the risk of chasing debt.

However, it is also true that some foreign firms are malicious and charge users large additional fees, despite having a zero-cut set up.

It is advisable to use a reputable international forex broker.

For more information on XM leverage, see the following article.

Earn XM points for every transaction, with bonus redemption.

The XMP Loyalty Programme is a unique XM service that allows customers to earn points every time they make a purchase.

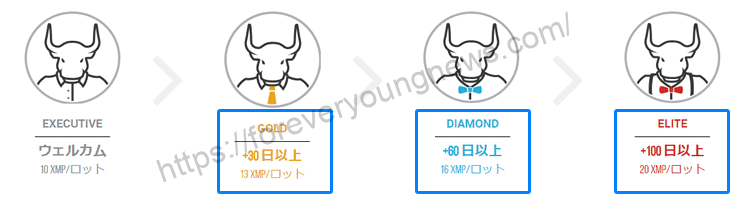

Specifically, 10 to 20 points are accumulated per lot (100,000 currency) of trading.

These points can be converted into bonuses.

The programme also has ranks, which go from EXECUTIVE to GOLD to DIAMOND to ELITE, depending on the length of the transaction.

For more information on XM points, see the following article.

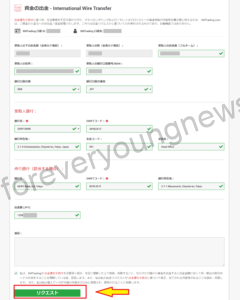

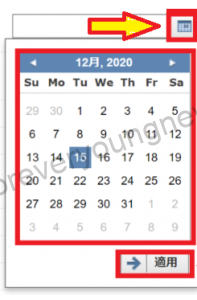

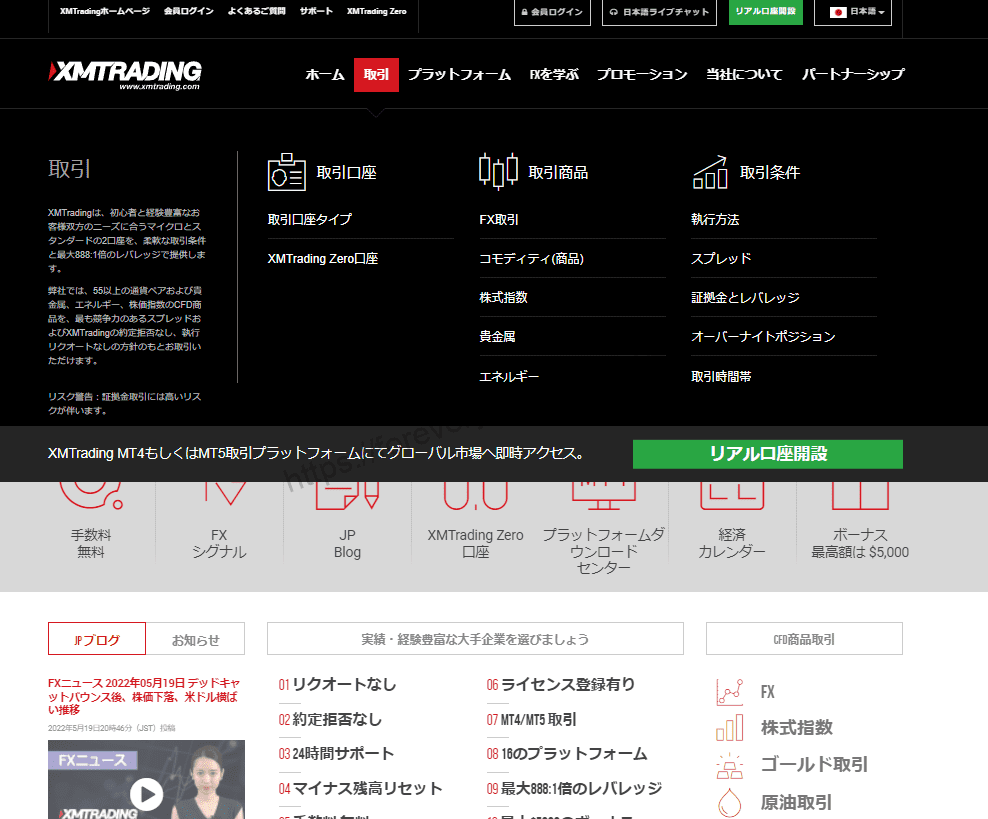

The website is fully in Japanese. Japanese language support is also available.

As can be seen from the official XM website, the XM homepage and My Page are completely in Japanese and are quite easy to use.

Of course, the trading tools are also in Japanese. Even if you cannot read English at all, you can trade without problems.

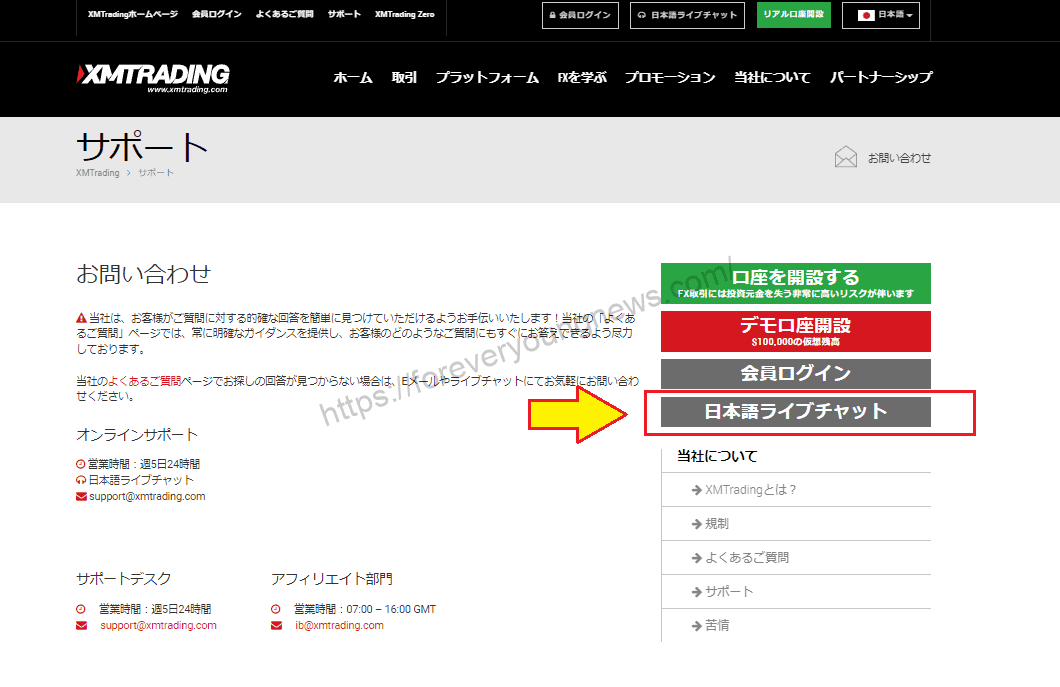

The Japanese-language support system is also quite good, with chat, email and call-backs all handled by Japanese staff; XM has 17 dedicated Japanese staff, so you can use the service as if you were using a domestic forex broker.

For more information on XM Japanese customer support, see the following article.

Disadvantages of XM

Wider spreads

XM's spreads are slightly wider than those of other forex companies.

XM uses the NDD method, so its only profit is the spread, which has to be wide.

However, the spreads are not extremely wide and are only slightly wider than those of other operators.

The normal spread of XM does not particularly increase trading costs, so if you are concerned about the spread, please use a ZERO account or another broker.

Outside the jurisdiction of the Japanese FSA.

XM's Japanese clients operate under a Seychelles Island financial licence, not a Japanese FSA licence.

As such, they are forex firms outside the jurisdiction of the Japanese FSA. In the past, the FSA has regarded foreign FX firms as illegal and has instructed them to change their business form if they operate in Japan.

Therefore, XM may also be subject to intervention by the Japanese FSA in the unlikely event of an incident.

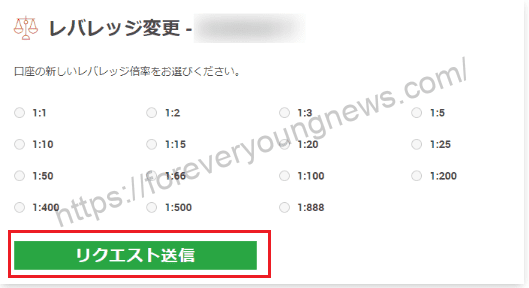

XM has leverage limits.

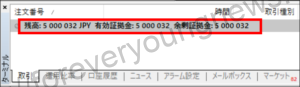

XM has leverage limits. Up to an account balance of JPY 2 million, 888 times leverage is possible.

It is important to note that leverage is limited by the total amount of active margin in the account held by the same account. It is limited by the total amount of bonuses (credits) and unrealised gains/losses that cannot be withdrawn.

| Total effective margin | Maximum leverage |

| ~Up to $20,000 (equivalent to ¥2 million) | 888 times |

| USD 20 000 - USD 100 000 (JPY 2 000 000 000 - JPY 10 000 000 000). | Regulated 200 times |

| From $100,000 and above (¥10 million and above) | Regulated 100 times |

For those who trade in large volumes, this is a weakness.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

summary

This article has described the advantages and disadvantages of XM.

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!