In this article.XM zero.(ZERO) account, and explains the advantages and disadvantages of the account.

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

Advantages and disadvantages of a zero (ZERO) account with XM.

Advantages of a zero account

Advantages of a zero account

- Wider spreads than standard accounts

- Account opening bonus to test its usability.

- You can start trading with as little as ¥500.

There are three main advantages of using XM's Zero Account: 1.

Let's look at each of these in turn.

Wider spreads than standard accounts

Narrow spreads are the main feature of the ZERO account.

For example, in the case of USD/JPY, the currency most traded by Japanese, the average spread for a Standard account is 1.6 pips, while the average spread for a ZERO account is 0.1 pips.

| currency pair | standard account | Zero account (not including commissions) |

|---|---|---|

| USD/JPY | 1.6 pips | 0.1 pips |

| EUR/JPY | 2.3 pips | 0.4 pips |

| EUR/USD | 1.7 pips | 0.1 pips |

Account opening bonus to test its usability.

XM's ZERO account offers a margin bonus of JPY 3,000 when opening a new account.

With this ¥3,000 bonus, you can test the usability of the ZERO account with zero risk.

For more information on the XM bonus, see the following article.

You can start trading with as little as ¥500.

The XM zero account has a minimum deposit set at 500.

For example, Gemforex's [no spread account], which has the same specifications as the XM zero account, has a high minimum deposit of JPY 300 000.

Disadvantages of zero accounts

Disadvantages of zero accounts

- A transaction fee of $10 round-trip is charged.

- Maximum leverage limited to 500 times.

- Cannot trade CFD stocks.

Although the XM zero account has various advantages, it also has disadvantages. The three main disadvantages of zero accounts are listed above.

Let's look at each of these in turn.

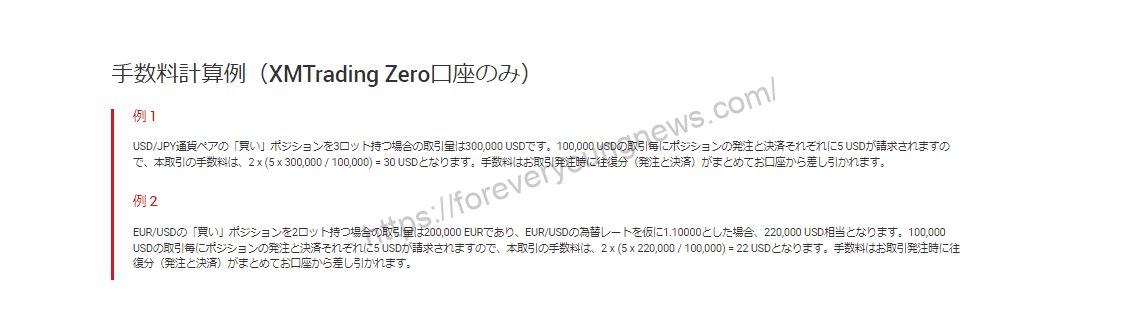

A $10 round-trip transaction fee (external commission) is charged.

The spreads on the Zero account are much narrower than those on the Standard and Micro accounts.

Zero accounts, on the other hand, have a round-trip transaction fee (external commission) of USD 10 instead of narrower spreads.

In the spread calculation, $10 is equal in value to 1 pips. This means that if you have to pay a $10 transaction fee, you have to pay the spread plus +1 pips.

Therefore, the average spread for USD/JPY on a Zero account is [0.1 pips + 1 pips commission], which is 1.1 pips.

For more information on fees for XM zero accounts, see the following article.

Maximum leverage limited to 500 times.

XM's standard and micro accounts have a maximum leverage of 1,000 times.

On the other hand.Maximum leverage on zero accounts limited to 500 times.The following information is available.

Therefore, you need to deposit more margin compared to a standard account, which allows you to trade in the same 100,000 currencies.

Cannot trade CFD stocks.

Zero accounts have fewer currency pairs to trade than standard or micro accounts.

You can trade FX currency pairs and precious metals such as gold and silver, but you cannot trade CFD stocks such as virtual currencies or stock indices.

Issues that cannot be traded on a zero account

- Stock indices: e.g. Nikkei Stock Average and NY Dow.

- Commodities: wheat, soya and other commodities.

- Energy: oil, gas, etc.

- Virtual currencies: bitcoin, ethereum, etc.

The stocks listed above cannot be traded on a zero account.

No bonuses other than the ¥3,000 new account opening bonus.

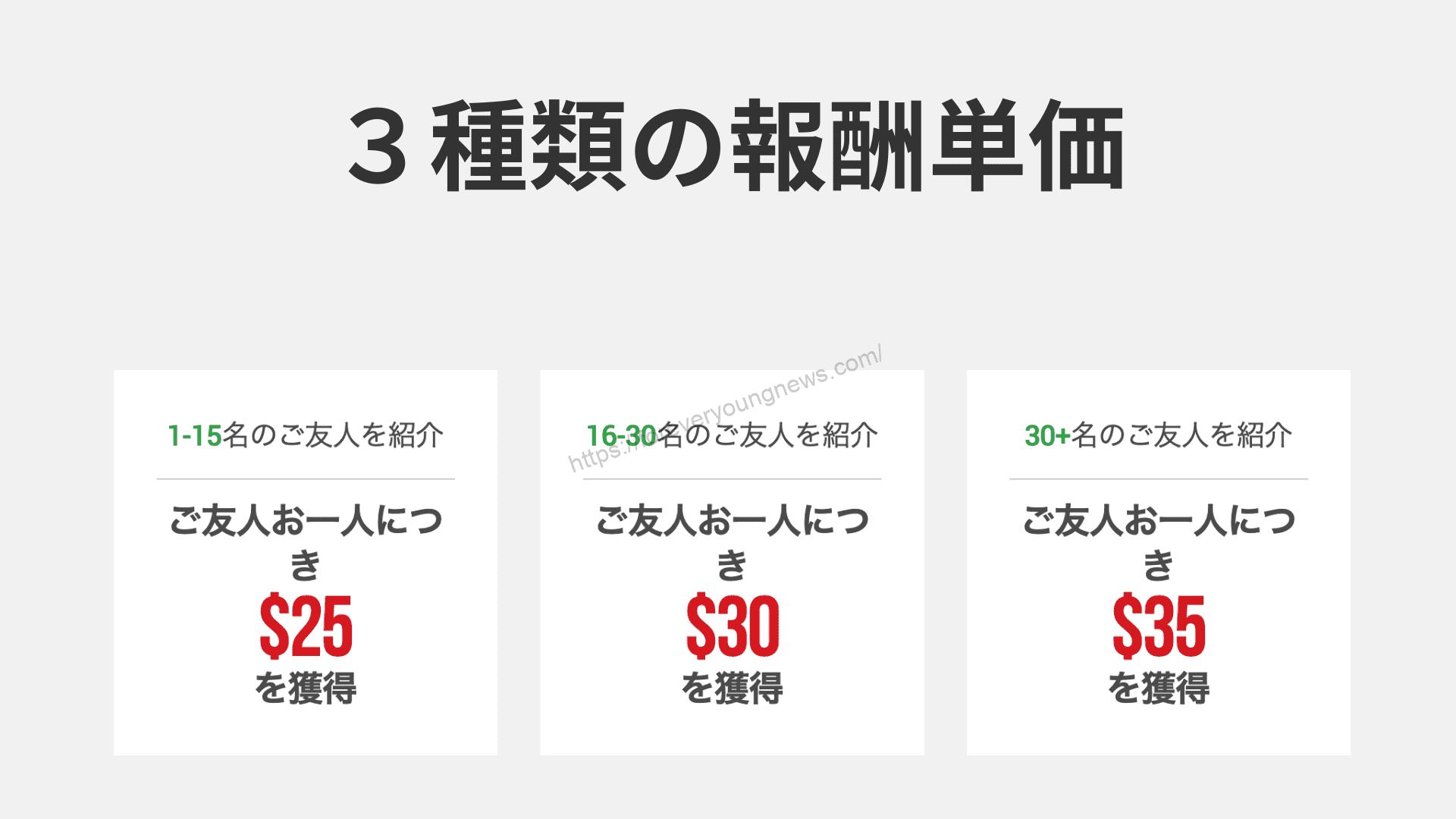

XM offers six different bonus promotions for standard and micro accounts: new account opening bonus, deposit bonus, trading bonus (loyalty programme) and refer-a-friend bonus.

XM also offers event bonuses such as the Hanami Bonus and the New Year's Day Bonus, of which the Zero Account receives a ¥3,000 account opening bonus only when opening a new account.

| bonus | Amount granted | Nil account |

| New account opening bonus | 3,000 yen | Subject. |

| 100% deposit bonus | 50,000. | not subject (to) |

| 20% deposit bonus | 450,000. | not subject (to) |

| Transaction bonuses (loyalty programmes) | Approx. 350-750 yen per lot. | not subject (to) |

| Special invitation bonus | Varies according to campaign. | not subject (to) |

| Refer-a-friend bonus | 3,500 per person max. | not subject (to) |

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

summary

This article describes the advantages and disadvantages of a zero (ZERO) account with XM.

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!