In this article.XMThis section explains about [lots], which is an unavoidable part of doing business in the market.

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

What are [lots]?

In forex, [lot] is a trading unit.

Due to the large trading units in forex trading, lots are used for one unit of currency to make it easier to keep track of the volume of transactions.

For example, when you buy eggs in a supermarket, you usually buy [a pack] that contains several eggs.

The same applies to forex, with forex companies deciding on one lot for 10 000 currency, [one lot] for 100 000 currency and so on.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

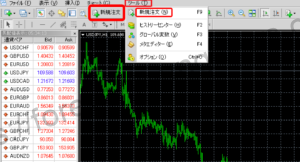

How much is one lot of XM (XMTrading)?

1 lot of XM (XMTrading) depends on the account type.

One lot of XM varies for each account type.

The amount of currency per lot of XM is as follows respectively

| account type | 1 lot currency amount |

| micro-account | 1,000 Currency |

| standard account | 100,000 Currency |

| XM Zero account | 100,000 Currency |

Micro accounts have 1/100th the amount of currency of Standard and XM Zero accounts.

XM (XMTrading), 1 lot = 100 000 currency.

Basically, for XM, 1 lot = 100,000 currency.

One lot of XM can be summarised as follows.

standard account

The most popular account type at XM is the Standard account. This account type is most recommended for beginners.

One lot is 100,000 currency, which is a common unit for international FX traders, but XM's Standard account allows trading from 0.01 lot (1,000 currency).

The risk is also smaller with 1,000-currency lots.

Of course, if you want to trade in larger lots, you can also trade in 50 lots = 5,000,000 currency - a buy position of 5,000,000 currency would result in a profit of 5 million yen with just 100 pips.

Even if 7 pips are gained by scalping, the profit is 350,000 yen. Thus, by increasing the number of lots, it is possible to earn the monthly income of a salaried worker in a day.

XM Zero account

XM's XM Zero account is attractive because of its narrow spreads, but this account is intended for intermediate and advanced users.

As with the Standard account, one lot is 100,000 currency, but the minimum amount of currency traded is 0.1 lot = 10,000 currency.

The XM Zero account is not recommended for beginners due to the minimum deposit of JPY 10,000.

micro-account

XM micro accounts have 1,000 currency lots and the minimum amount of currency traded is 0.01 lot = 10 currencies.

Remember that 1 lot = 100,000 currency for XM, as few people choose this account.

Beginners should choose a standard account.

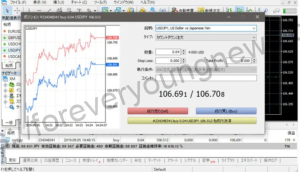

How much margin is required for an order of 1 lot in XM?

Formula for calculating margin requirements

Rate x currency units ÷ leverage = margin requirement

standard account

For standard accounts, one lot is 100,000 currency.

Assuming USD/JPY = 110 yen, 100,000 currencies, so JPY 11 million is required.

For XM, leverage of 888 times is available.

110 yen (rate) x 100,000 currency ÷ 888 (leverage) = approximately 12,387 yen.

micro-account

For micro accounts, one lot is 1,000 currency.

If the dollar = 110 yen, you will need 110,000 yen.

The same 888x leverage is available on micro accounts as on standard accounts.

110 yen (rate) x 1,000 currency / 888 (leverage) =.Approx. 124 yen.

XM Zero account

In a zero account, one lot is 100,000 currency.

Zero account leverage of 500 times is available.

110 (rate) x 100,000 currency ÷ 500 (leverage) = 22,000 yen.

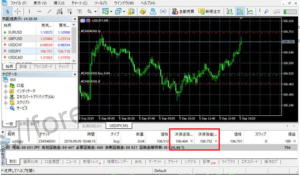

Let's figure out the profit per lot.

In foreign exchange trading, it is also important to understand the profit earned per lot.

When assessing profit, it is necessary to understand the unit of measure known as 'pips'. Pips stands for [Percentage In Point] and is the smallest unit of currency price range.

The amount per pip depends on whether the currency pair includes [Japanese yen] or not.

See below.

If Japanese yen is included: 1 pips = 1 sen = 0.01 yen

If Japanese yen is not included: 1 pips = 0.01 cents = $0.0001

In Forex, the profit margin earned is expressed as [0 pips won/lost], and if you win 100 pips, you have made a profit on a ¥1 price movement.

Profit per pips

The profit per pips earned depends on the number of lots (number of currencies) and[number of currencies traded x profit margin].This can be calculated in the following way.

For example, if you trade USD/JPY on a XM micro account with 888x leverage and a maximum lot size of 40 lots (4,000,000 currencies), the profit from a one-pips change is [.4,000,000 currency x ¥0.01 = ¥40,000]This will be the case.

This means that a fluctuation of 1 pips can earn you [JPY 40,000], and since fluctuations of JPY 0.01 occur frequently, you can aim for a profit of more than JPY 40,000 in a matter of seconds.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!

summary

In this article.The XM lot was explained in detail.

XMwellCompletely free demo account versionis available, so you can try it out risk-free.

Also, XM is giving away a $30 trading bonus to anyone who opens a new account!For more information, visit the official website atPlease check from the following links.

↓arrow (mark or symbol)

Click here for the official XM website.

*Now we're giving away a $30 bonus!